losing your rights

Effective January 1, 2025, licensed manicurists in California will lose their right to work as independent contractors.

how did this happen?

It’s complicated, but here’s the simple answer.

OLD NEWS

The AB 5 law (signed 2019) included an exemption that allowed all BBC licensees to work as independent contractors.

BAD NEWS

The same law singled out licensed manicurists by limiting our exemption with an inoperative date of January 1, 2022.

GOOD NEWS

AB 1561 (signed 2021) extended our exemption with a new inoperative date of January 1, 2025, providing 3 more years to resolve this issue.

TERRIBLE NEWS

No other bills have been passed since to extend or eliminate this inoperative date and January 1, 2025 will be here soon.

- 00DAYS

- 00HOURS

- 00MINUTES

- 00SECONDS

ADVOCACY IN ACTION: AB 5

ACTION: Five years ago, I wrote a series of articles to argue for the inclusion of licensed manicurists in the exemptions granted in AB 5: Independent or Employee? Losing Your Right to Choose (July 2019) and Finding Your Space vs. Knowing Your Place (August 2019).

REACTION: Combined with the diligent efforts of Wendy Cochran, licensed esthetician and founder of the California Aesthetic Alliance, our message of inclusion of all licensed beauty professionals, not just those who do hair, broke through to the industry, state board and legislators. Read more about how AB 5 evolved from excluding the beauty industry to including us.

RESULT: The final version of the bill gives an exemption to all BBC licensees with reasonable requirements, like reinforcing that the individual must issue a Form 1099 to the salon owner. However, manicurists failed to secure the permanent exemption that other licensees received.

ADVOCACY IN ACTION: AB 1561

ACTION: Three years ago (July 2021), I submitted a 200-word letter to support AB 1561.

REACTION: My argument was quoted extensively in the Senate Floor Analyses. Note that Precision Nails stands alone as the ONLY support from the beauty industry on record.

RESULT: This bill succeeded in extending our exemption until January 1, 2025. Read AB 1561 here.

VERSION ONE (December 3, 2018)

Introduced by Assemblymember Lorena Gonzalez, Assembly Bill 5 (AB 5) contains no exemptions for any person or profession.

VERSION TWO (March 26, 2019)

Revised to include exemptions for only four professional categories:

“A person or organization who is licensed by the Department of Insurance …”

“A physician and surgeon licensed by the State of California …”

“A securities broker-dealer or investment adviser or their agents and representatives that are registered with the Securities and Exchange Commission or the Financial Industry Regulatory Authority or licensed by the State of California …”

“A direct sales salesperson as described in Section 650 of the Unemployment Insurance Code …”

VERSION THREE (May 1, 2019)

Maintained same limited number of exemptions as previous version.

VERSION FOUR (May 24, 2019)

Added only two exemptions:

“A real estate licensee licensed by the State of California …”

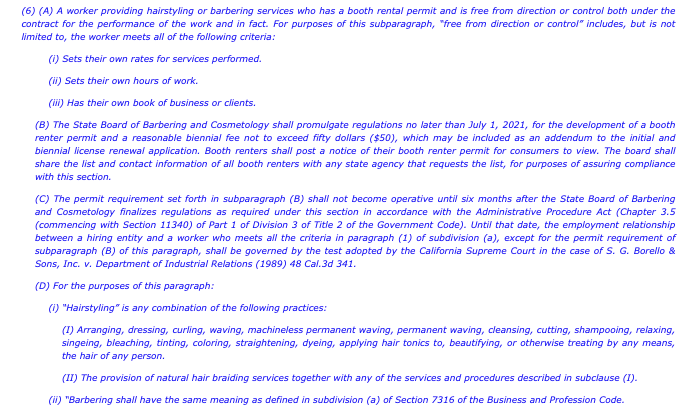

“A worker providing hairstyling or barbering services who has a booth rental permit …”

Requirement of a booth rental permit which did not exist, but was proposed in this bill.

NOTE:

• Limitation to only those who perform hair services when a hairstyling license did not exist at this time.

• Use of the term “worker” whereas other professionals defined according to their licensure.

VERSION FIVE (July 11, 2019)

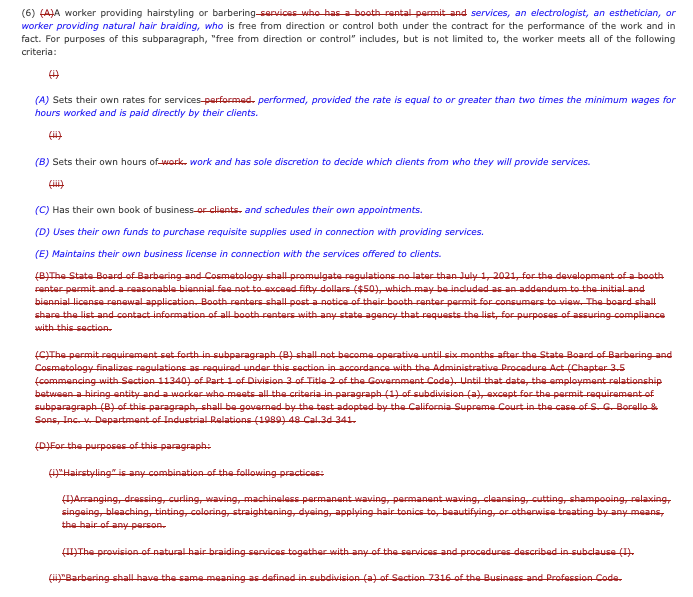

Expanded the exemptions to include “an electrologist, and esthetician, or worker providing natural hair braiding” and eliminated the booth rental permit requirement and language.

NOTE:

• Absence of any reference to nail services or manicurists.

• Use of the license title for electrologists and estheticians.

• Addition of requirements regarding setting rates and direct payment, scheduling clients, purchasing supplies and maintaining a business license.

• Inclusion of natural hair braiding when California’s Board of Barbering and Cosmetology does not regulate that service.

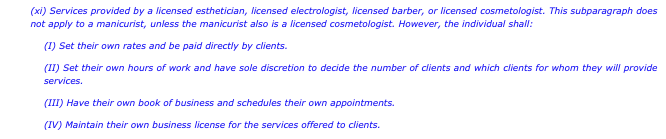

VERSION SIX (August 30, 2019)

Updated to reflect professional licensure, but purposefully names manicurists to exclude us from the exemption.

NOTE:

• Elimination of requirement about purchasing own supplies.

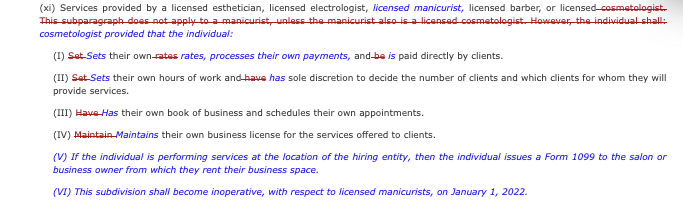

VERSION SEVEN (September 6, 2019)

FINALLY! In the last possible revision, licensed manicurists earned an exemption, but with an expiration (“inoperative”) date of January 1, 2022.

IMPORTANT:

• Requirement that the individual issue a Form 1099 to the salon or business owner.

Want to know more about AB 5, the ABC test and Borello test? California’s Labor Commissioner’s Office provides this overview.

DISCLAIMER: Precision Nails provides these links for convenience and information purposes only. The content of this site should not be considered legal advice. Precision Nails assumes no responsibility for the content, accuracy, validity or use of these links; contact the source directly for the most current and relevant information.

frequently asked questions

WARNING! This represents my best effort to comply and explain based on my extensive involvement in the legislative process. (Note the phrasing of questions and answers.) Please contact a legal expert to review your specific situation.

Starting in 2025, what are the options for working as a licensed manicurist in California?

I can work in my own salon (which requires that I hold an establishment license issued by the BBC), or work for another salon owner as a W2 employee.

Does this restriction apply to other license types: barbers, cosmetologists, electrologists or estheticians?

No, only to licensed manicurists. We’re special that way.

What about salon owners who currently rent space to manicurists?

No doubt the legislature and regulatory agencies would be happy if all those independent contractors were converted to W2 employees.

Can a room be considered an establishment?

Unless a location qualifies with its own distinct address, the BBC will not be able to issue an establishment license.

What about dual-licensed professionals?

Unless a person holds a cosmetologist license, they should not be doing nail services as an independent contractor.

Why don’t more manicurists and salon owners know about this?

As an industry, we’re not known for our political engagement and advocacy. Wendy Cochran, licensed esthetician and founder of the California Aesthetic Alliance, and I have been the only licensees continuously fighting for the inclusion and rights of all BBC license types.

next steps

Advocate for yourself and our industry by communicating respectfully with your state representatives. In your own words, tell your story about how this drastic change will impact your business and finances.