Effective January 1, 2025, licensed manicurists in California lost their right to work as independent contractors.

GOOD NEWS, FINALLY

On February 10, 2025, Assemblyman Tri Ta introduced AB 504 to “correct racial targeting in state employment law.”

“Other license types issued by the Board of Barbering and Cosmetology allow licensees to be classified as independent contractors,” said Assemblyman Ta. “When exemptions were being negotiated, manicurists—most of whom are Vietnamese women—were singled out for disparate treatment. This bill seeks to correct that injustice and provide equality under California law.”

The legislative process begins and we need your support to ensure this bill succeeds in becoming law.

Updates will be posted here, so please bookmark this page.

It’s complicated, but here’s the simple answer.

OLD NEWS

The AB 5 law (signed 2019) included an exemption that allowed all BBC licensees to work as independent contractors.

BAD NEWS

The same law singled out licensed manicurists by limiting our exemption with an inoperative date of January 1, 2022.

GOOD NEWS

AB 1561 (signed 2021) extended our exemption with a new inoperative date of January 1, 2025, providing 3 more years to resolve this issue.

TERRIBLE NEWS

Despite the introduction of three different bills, no bills passed to extend or eliminate the inoperative date of January 1, 2025.

ACTION: Five years ago, I wrote a series of articles to argue for the inclusion of licensed manicurists in the exemptions granted in AB 5: Independent or Employee? Losing Your Right to Choose (July 2019) and Finding Your Space vs. Knowing Your Place (August 2019).

REACTION: Combined with the diligent efforts of Wendy Cochran, licensed esthetician and founder of the California Aesthetic Alliance, our message of inclusion of all licensed beauty professionals, not just those who do hair, broke through to the industry, state board and legislators. Read more about how AB 5 evolved from excluding the beauty industry to including us.

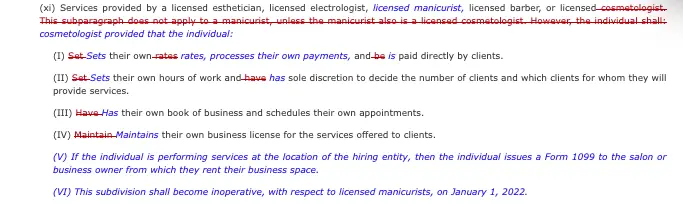

RESULT: The final version of the bill gives an exemption to all BBC licensees with reasonable requirements, like reinforcing that the individual must issue a Form 1099 to the salon owner. However, manicurists failed to secure the permanent exemption that other licensees received.

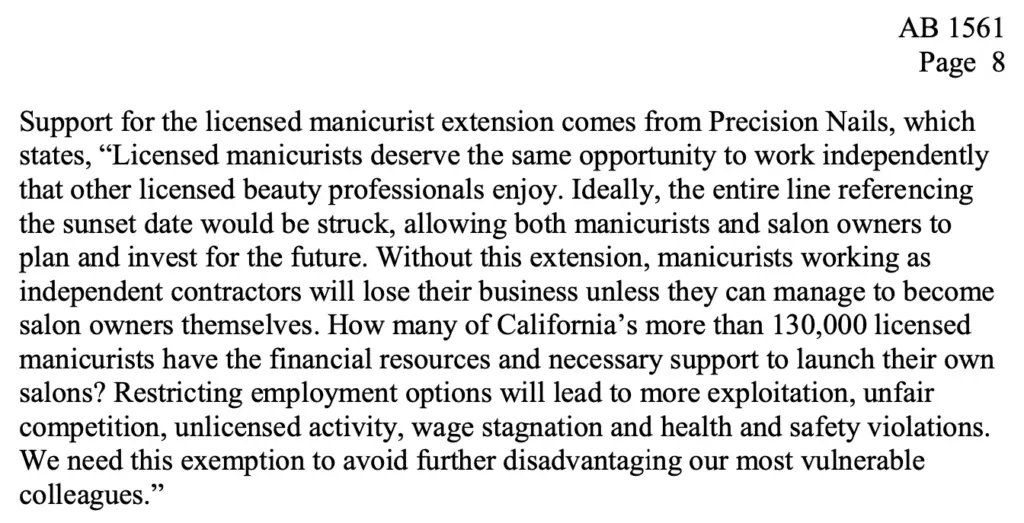

ACTION: Three years ago (July 2021), I submitted a 200-word letter to support AB 1561.

REACTION: My argument was quoted extensively in the Senate Floor Analyses. Note that Precision Nails stands alone as the ONLY support from the beauty industry on record.

RESULT: This bill succeeded in extending our exemption until January 1, 2025. Read AB 1561 here.

VERSION ONE (December 3, 2018)

Introduced by Assemblymember Lorena Gonzalez, Assembly Bill 5 (AB 5) contains no exemptions for any person or profession.

VERSION TWO (March 26, 2019)

Revised to include exemptions for only four professional categories:

“A person or organization who is licensed by the Department of Insurance …”

“A physician and surgeon licensed by the State of California …”

“A securities broker-dealer or investment adviser or their agents and representatives that are registered with the Securities and Exchange Commission or the Financial Industry Regulatory Authority or licensed by the State of California …”

“A direct sales salesperson as described in Section 650 of the Unemployment Insurance Code …”

VERSION THREE (May 1, 2019)

Maintained same limited number of exemptions as previous version.

VERSION FOUR (May 24, 2019)

Added only two exemptions:

“A real estate licensee licensed by the State of California …”

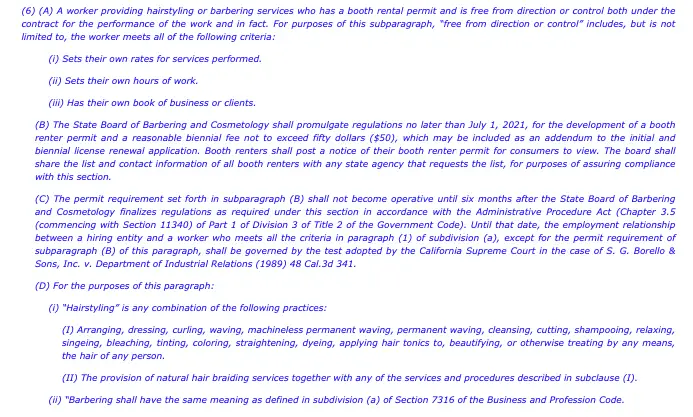

“A worker providing hairstyling or barbering services who has a booth rental permit …”

Requirement of a booth rental permit which did not exist, but was proposed in this bill.

NOTE:

• Limitation to only those who perform hair services when a hairstyling license did not exist at this time.

• Use of the term “worker” whereas other professionals defined according to their licensure.

VERSION FIVE (July 11, 2019)

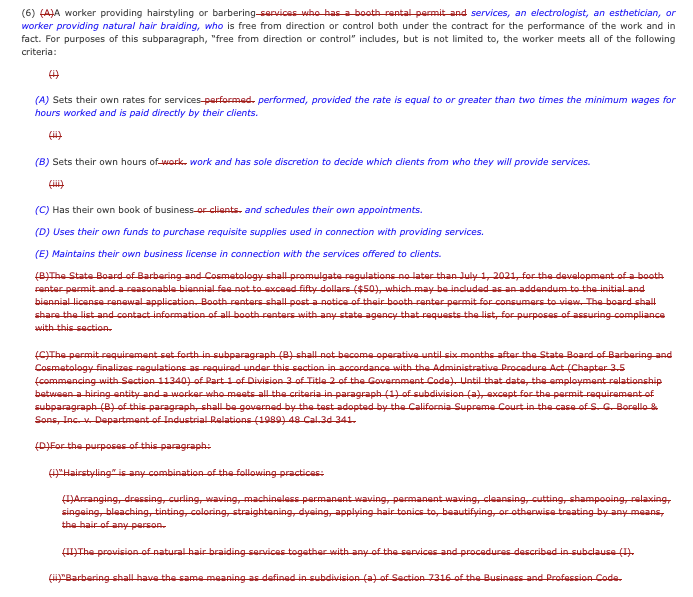

Expanded the exemptions to include “an electrologist, and esthetician, or worker providing natural hair braiding” and eliminated the booth rental permit requirement and language.

NOTE:

• Absence of any reference to nail services or manicurists.

• Use of the license title for electrologists and estheticians.

• Addition of requirements regarding setting rates and direct payment, scheduling clients, purchasing supplies and maintaining a business license.

• Inclusion of natural hair braiding when California’s Board of Barbering and Cosmetology does not regulate that service.

VERSION SIX (August 30, 2019)

Updated to reflect professional licensure, but purposefully names manicurists to exclude us from the exemption.

NOTE:

• Elimination of requirement about purchasing own supplies.

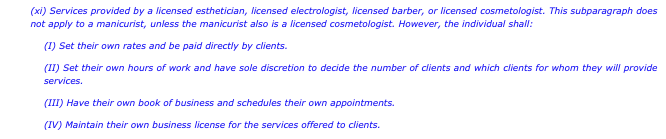

VERSION SEVEN (September 6, 2019)

FINALLY! In the last possible revision, licensed manicurists earned an exemption, but with an expiration (“inoperative”) date of January 1, 2022.

IMPORTANT:

• Requirement that the individual issue a Form 1099 to the salon or business owner.

Want to know more about AB 5, the ABC test and Borello test? California’s Labor Commissioner’s Office provides this overview.

The Department of Industrial Relations (DIR) and the Board of Barbering Cosmetology (BBC) issued this statement on October 7, 2024 to inform licensees: “beginning January 1, 2025, if you are a licensed manicurist, and you provide manicure services at a salon, you are an employee, and must receive all the rights and protections of that employment status including minimum wage, sick pay, meal and rest breaks, overtime pay and workers compensation insurance coverage.” Read the complete statement here.

DISCLAIMER: Precision Nails provides these links for convenience and information purposes only. The content of this site should not be considered legal advice. Precision Nails assumes no responsibility for the content, accuracy, validity or use of these links; contact the source directly for the most current and relevant information.

WARNING! This represents my best effort to comply and explain based on my extensive involvement in the legislative process. (Note the phrasing of questions and answers.) Please contact a legal expert to review your specific situation.

Starting in 2025, what are the options for working as a licensed manicurist in California?

I can work in my own salon (which requires that I hold an establishment license issued by the BBC), or work for another salon owner as a W2 employee.

Does this restriction apply to other license types: barbers, cosmetologists, electrologists or estheticians?

No, only to licensed manicurists. We’re special that way.

What about salon owners who currently rent space to manicurists?

No doubt the legislature and regulatory agencies would be happy if all those independent contractors were converted to W2 employees.

Can a room be considered an establishment?

Unless a location qualifies with its own distinct address, the BBC will not be able to issue an establishment license.

What about doing nails in your home?

The BBC will issue an establishment license for a home-based salon that meets the additional requirements.

What about dual-licensed professionals?

Unless a person holds a cosmetologist license, they should not be doing nail services as an independent contractor.

Why don’t more manicurists and salon owners know about this?

As an industry, we’re not known for our political engagement and advocacy. Wendy Cochran, licensed esthetician and founder of the California Aesthetic Alliance, and I have been the only licensees continuously fighting for the inclusion and rights of all BBC license types.

Advocate for yourself and our industry by communicating respectfully with your state representatives. In your own words, tell your story about how this drastic change will impact your business and finances.

For three consecutive years, legislator Janet Nguyen introduced a bill that would have resolved this issue, but each of them died without any consideration.

AB 231

INTRODUCED: January 12, 2021

“This bill would delete the January 1, 2022, inoperative date, thereby making licensed manicurists subject to this exemption indefinitely.”

DIED: January 31, 2022

Pursuant to Art. IV, Sec. 10(c) of the Constitution: “(c) Any bill introduced during the first year of the biennium of the legislative session that has not been passed by the house of origin by January 31 of the second calendar year of the biennium may no longer be acted on by the house.”

AB 1818

INTRODUCED: February 17, 2022

“This bill would delete the January 1, 2025, inoperative date, thereby making licensed manicurists subject to this exemption indefinitely.”

DIED: November 30, 2022

Though referred to the Assembly Committee on Labor and Employment (February 13, 2022), no further action was taken.

INTRODUCED: February 13, 2023

“This bill would delete the January 1, 2025, inoperative date, thereby making licensed manicurists subject to this exemption indefinitely.”

AMENDED: March 20, 2023

The author revised the bill to “extend the exemption for licensed manicurists, making it inoperative on January 1, 2030.”

Though set for first hearing on April 26, 2023 in the Senate Labor, Public Employment and Retirement Committee, SB 451 was never heard: “April 26 set for first hearing canceled at the request of author.”

DIED: February 1, 2024

Returned to Secretary of Senate pursuant to Joint Rule 56: “Bills introduced in the first year of the regular session and passed by the house of origin on or before the January 31st constitutional deadline are ‘carryover bills.’ Immediately after January 31, bills introduced in the first year of the regular session that do not become “carryover bills’ shall be returned to the Chief Clerk of the Assembly or Secretary of the Senate, respectively.

To provide the best experience, we use technologies like cookies to store and/or access device information. Consenting to these technologies will allow us to process data such as browsing behavior or unique IDs on this site. Not consenting or withdrawing consent, may adversely affect certain features and functions.